IAS 36: Impairment of Assets

By NG ENG JUAN

ALLOCATION OF GOODWILL IMPAIRMENT LOSS

IAS 36 Impairment of Assets provides that goodwill impairment loss should be “allocated between the parent and the non-controlling interest on the same basis as that on which profit or loss is allocated” (paragraph C6).

The purpose of this article is to discuss the appropriateness of the above provision of IAS 36.

BACKGROUND INFORMATION

IFRS 3 Business Combinations provides that goodwill at the acquisition date (assuming no step acquisition) should be measured as the excess of the aggregate of the consideration transferred and the amount of non-controlling interest over the fair value of identifiable net assets of subsidiary acquired (paragraph 32).

In mathematical formula, the requirement of paragraph 32 above may be presented as follows:

Goodwill at acquisition date = parent’s cost of acquisition plus non-controlling Interest less fair value of identifiable net assets of subsidiary acquired

In the above formula, there are three dependent variables, namely, (i) parent’s cost of acquisition, (ii) non-controlling interest, and (iii) fair value of identifiable net assets of subsidiary acquired. While the quantum of variables (i) and (iii) may be quite objectively determined, the quantum of variable (ii) (that is, non-controlling interest) is dependent on the basis used to measure the non-controlling interest at acquisition date.

IFRS 3 provides for two measurement bases for non-controlling interest at acquisition date. Specifically, IFRS 3 provides that non-controlling interest at acquisition date (assuming it comprises only ordinary shares) may be measured at either (i) its proportionate share of the fair value of identifiable net assets of subsidiary acquired, or (ii) its fair value (paragraph 19).

Thus, the quantum of goodwill at acquisition date is very much dependent on the basis used to measure non-controlling interest at acquisition date. To illustrate, assume the following case:

CASE 1

P Ltd acquires 60% of S Ltd for $300 million. At the acquisition date, S Ltd’s balance sheet comprises Land carried at cost of $200 million, Share capital of $100 million (comprising 100 million ordinary shares issued at $1.00 per share) and Bank loan of $100 million.

Assume that on the acquisition date, the fair value of S Ltd’s land is $500 million, and the fair value of the shares held by non-controlling interest is $4.50 per share. (It may be noted that P Ltd’s cost of acquisition is more than the fair value of shares acquired, due to payment for, inter alia, control premium.)

In the above case, the non-controlling interest at acquisition date may be measured based on “its share of the fair value of identifiable net assets of subsidiary acquired” of $160 million (40% x ($500 million for Land – $100 million for Bank loan)), or based on “its fair value” of $180 million (40 million shares x $4.50).

If the non-controlling interest is measured based on “its share of the fair value of identifiable net assets” of $160 million, and applying the formula in paragraph 32 of IFRS 3, goodwill may be calculated as equal to $60 million ($300 million + $160 million – $400 million).

If the non-controlling interest is measured based on “its fair value” of $180 million, and applying the formula in paragraph 32 of IFRS 3, goodwill may be calculated as equal to $80 million ($300 million + $180 million – $400 million).

It may be noted from the above that the quantum of goodwill at acquisition date may differ as the result of the use of the different measurement basis for non-controlling interest.

To better understand the effect of the use of the different measurement basis for non-controlling interest on the quantum of goodwill, the formula in paragraph 32 may be re-phrased as follows:

Goodwill at acquisition date = (parent’s cost of acquisition less parent’s share of the fair value of net identifiable assets of subsidiary acquired) plus (non-controlling interest less non-controlling interest’s share of the fair value of identifiable net assets of subsidiary acquired)

With reference to Case 1 and applying the above formula:

- If the non-controlling interest is measured based on “its share of the fair value of identifiable net assets of subsidiary acquired” of $160 million, goodwill will be $60 million, being parent’s share of the goodwill of $60 million (parent’s cost of acquisition of $300 million lessparent’s share of the fair value of identifiable net assets of $240 million (60% x ($500 million for Land – $100 million for Bank loan)) plus non-controlling interest’s share of goodwill of $0 (non-controlling interest of $160 million less non-controlling interest’s share of the fair value of identifiable net assets of $160 million (40% x ($500 million for Land – $100 million for Bank loan))), and

- If the non-controlling interest is measured based on “its fair value” of $180 million, goodwill will be $80 million, being parent’s share of the goodwill of $60 million (parent’s cost of acquisition of $300 million less parent’s share of the fair value of identifiable net assets of subsidiary of $240 million) plus non-controlling interest’s share of goodwill of $20 million (non-controlling interest of $180 million less non-controlling interest’s share of the fair value of identifiable net assets of $160 million).

From the above, it may be noted that (i) if non-controlling interest is measured based on “its share of the fair value of identifiable net assets of subsidiary acquired”, there is no goodwill element in non-controlling interest; only the parent’s share of the goodwill will be accounted for in the consolidated financial statements, and (ii) if non-controlling interest is measured based on “its fair value”, there is both the parent’s share and the non-controlling interest’s share of goodwill to be accounted for in the consolidated financial statements, except that the parent share and the non-controlling share of the goodwill may not be reflective of their respective equity interest (example, in the above case, parent share of goodwill is $60 million and the non-controlling share of goodwill is $20 million, which does not reflect their 60%:40% equity interest).

ALLOCATION OF GOODWILL IMPAIRMENT LOSS

IAS 36 provides that goodwill impairment loss (assuming a less-than-100% held subsidiary is by itself a cash-generating unit) should be “allocated between the parent and the non-controlling interest on the same basis as that on which profit or loss is allocated” (paragraph C6).

It is contended that the above provision is appropriate (but not necessary) for a case where non-controlling interest is measured based on “its share of the fair value of identifiable net assets of subsidiary acquired”, but is inappropriate for a case where non-controlling interest is measured based on “its fair value”.

To support the above contention, assume the following case:

CASE 2

Same facts as in Case 1. Assume that S Ltd is by itself a cash-generating unit, and that subsequent to the date of acquisition, S Ltd’s recoverable amount is $420 million.

(a) Non-controlling interest measured based on “its share of the fair value of identifiable net assets of subsidiary acquired”

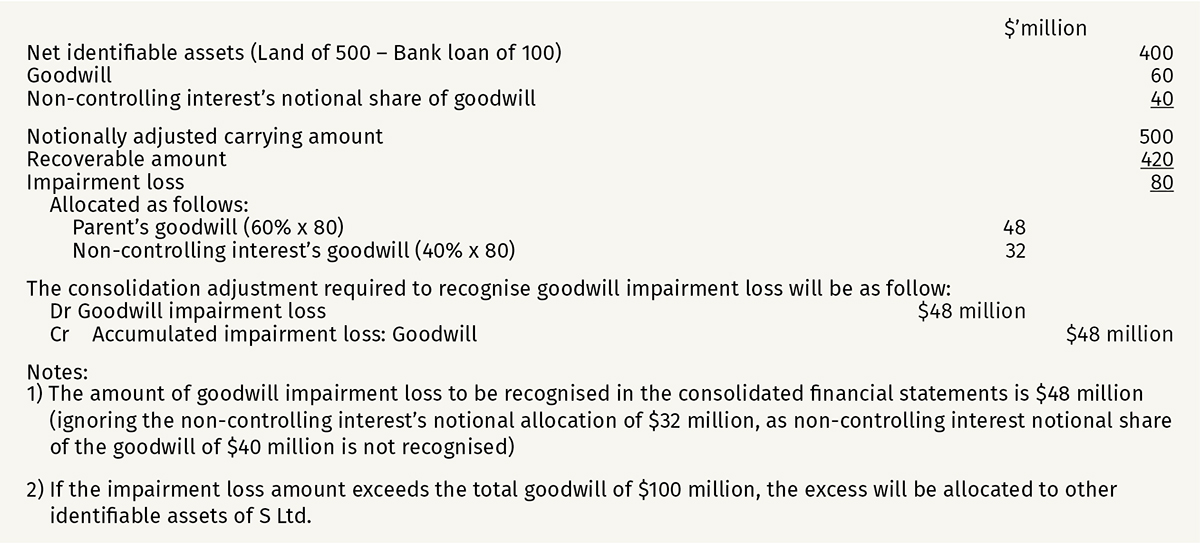

Where non-controlling interest is measured based on “its share of the fair value of identifiable net assets of subsidiary acquired”, paragraph C4 of IAS 36 provides that “an entity shall gross up the carrying amount of goodwill allocated to the unit to include the goodwill attributable to the non-controlling interest… this adjusted carrying amount is then compared with the recoverable amount of the unit to determine whether the cash-generating unit is impairment”, and paragraph C8 of IAS 36 provides that, if there is goodwill impairment, “only the impairment loss relating to the goodwill that is allocated to the parent is recognised as a goodwill impairment loss”.

To illustrate the provisions of paragraphs C4 and C8, refer to Case 2 above. To test for goodwill impairment under paragraph C4, the non-controlling interest’s notional share of the goodwill should first be computed as equal to $40 million (40% x ($60/60%) = $40), and then added to the carrying amount of S Ltd. The carrying amount of S Ltd (now inclusive of non-controlling interest’s notional share of goodwill) will then be compared with the recoverable amount of S Ltd to determine the amount of impairment loss. Subsequently, applying paragraph C8, only the amount of impairment loss allocated to parent’s goodwill will be recognised. The calculations are shown below:

As illustrated above, where non-controlling interest is measured based on “its share of the fair value of identifiable net assets of subsidiary acquired”, paragraphs C4 and C8 provide adequately on how to measure and recognise goodwill impairment loss in the consolidated financial statements. Paragraph C6, even though is appropriate, is not necessary.

(b) Non-controlling interest measured based on “its fair value”

Where non-controlling interest is measured based on “its fair value”, it is contended that the provision of paragraph C6 is not appropriate.

The main reason for the above contention is that where non-controlling interest is measured based on “its fair value”, both the parent share of goodwill and the non-controlling share of goodwill have to be accounted for, but the parent share and the non-controlling share of the goodwill may not be reflective of their respective equity interest.

To illustrate, it may be noted that in Case 1 above, where parent acquires a 60% equity interest in subsidiary, the parent’s and non-controlling interest’s equity interest is respectively 60% and 40%, and the basis on which the subsidiary’s profit or loss is allocated is therefore 60%:40%. However, parent share of goodwill is $60 million and the non-controlling share of goodwill is $20 million, which does not reflect their 60%:40% profit or loss allocation basis.

That being so, then applying the provision of paragraph C6 to a case where non-controlling interest is measured based on “its fair value” will be inappropriate.

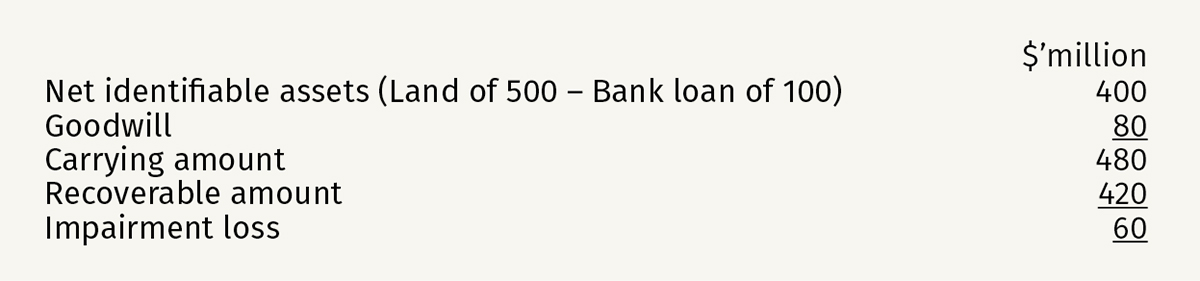

To illustrate, refer to Case 2 above. To recap the facts of the case, (i) parent has a 60% equity interest and non-controlling interest has 40% equity interest in the subsidiary, and therefore the profit or loss allocation will be based on the ratio of 60%:40%; (ii) the goodwill at acquisition date is $80 million, comprising parent’s share of $60 million, and non-controlling interest’s share of $20 million, and (iii) the goodwill impairment is $60 million, computed as shown below:

In this case, applying the provision of paragraph C6 that the goodwill impairment should be allocated based on the basis the profit or loss is allocated (that is, 60%:40%), the goodwill impairment loss allocated to parent will be $36 million (60% x $60 million), and the goodwill impairment loss allocated to non-controlling interest will be $24 million (40% x $60 million). This will result in non-controlling interest carrying a goodwill at a negative figure of $4 million ($20 million – $24 million), which obviously is inappropriate.

It is contended that, maybe the goodwill impairment loss should be allocated based on parent’s and non-controlling interest’s proportionate share of goodwill (and not based on the parent’s and non-controlling interest’s proportionate share of profit or loss).

If, in the above case, the goodwill impairment loss were to be allocated based on the proposed “parent’s and non-controlling interest’s proportionate share of goodwill”, the goodwill impairment loss allocated to parent would be $45 million ($60 million/$80 million x $60 million), and the goodwill impairment loss allocated to non-controlling interest would be $15 million ($20 million/$80 million x $60 million). Consequently, after the goodwill impairment loss allocation, parent share of goodwill will be $15 million ($60 million – $45 million), and non-controlling interest share of goodwill will be $5 million ($20 million – $15 million). The issue of carrying goodwill at a negative figure will not arise.

However, it should be noted that IAS 1 Presentation of Financial Statements requires financial statements to comply with all extant IAS/IFRS so as to present a true and fair view (paragraph 15). Deviation from the extant IAS/IFRS is allowed only under extreme rare circumstances (paragraph 19) and proper disclosures have to be made (paragraphs 20 and 23).1

CONCLUSION

This article contends that paragraph C6 of IAS 36 is (i) appropriate, but not necessary, in cases where the acquisition-date non-controlling interest is measured based on “its share of the fair value of identifiable net assets of subsidiary acquired”, and (ii) inappropriate in cases where the acquisition-date non-controlling interest is measured based on “its fair value”.

In cases where the non-controlling interest is measured based on “its share of the fair value of identifiable net assets of subsidiary acquired”, paragraphs C4 and C8 should be applied.

In cases where the non-controlling interest is measured based on “its fair value”, it is contended that goodwill impairment loss should be allocated based on the parent’s and non-controlling interest’s proportionate share of goodwill (and not on the basis as that on which profit or loss is allocated, as required by paragraph C6). However, the requirement of IAS 1 to comply with extant IAS/IFRS should be noted.

Ng Eng Juan is Professor in Accounting, Singapore University of Social Sciences.

1 In general, the auditor and the preparer of financial statements need to comply with IFRS standards. Deviations from them should be jointly resolved between auditors and preparers. At the minimum, the audited financial statements should also include disclosures on deviations from IFRS.

This article was first published in ISCA Journal. You can read the original version here.