Repositioning for the new reality

By PERRINE OH

COMING BACK STRONGER POST-CRISIS

When the dust finally settles on the coronavirus disease (Covid-19), the pandemic will leave behind an indelible mark in the history of mankind. The world will change. Healthcare systems will be revamped or at the very least, improved, in many countries. People will behave differently – they may still avoid crowds post-pandemic. The way we work will change too. While businesses tackle the immediate challenges, those with an eye on the future as well will be the ones who can keep ahead of the competition.

The best approach to navigate the Covid-19 crisis and subsequent recovery will differ according to the unique circumstances of each business. One thing is for sure – businesses need to be very deliberate in planning for recovery. In this article, we explore how businesses can re-think assumptions regarding business practices, prepare themselves to bounce back stronger in the new business environment, and consider how their business and/or operating model would change given the new reality.

PLANNING AHEAD

Consulting firm McKinsey & Company advocates forming a “Plan-Ahead Team” which is made up of a few small but scalable planning groups. The team must be adaptable and be able to work with uncertainty. This is because as new information surfaces, it has to adjust and adapt its crisis-action plan accordingly.

Using the McKinsey Strategic Crisis-Action Plan Framework as one possible guide, the team can develop a crisis-action plan by going through the following five stages across multiple time frames, ranging from the immediate to longer term after two years, to cope with the new reality.

MCKINSEY STRATEGIC CRISIS-ACTION PLAN FRAMEWORK

Stage 1 Gain a realistic view of the starting point

Take stock of the business’ financial assumptions, ongoing initiatives, and major strategic choices. A three-year plan with the planning assumptions will help determine what drives the financial performance of the business. It would also be useful to perform a quick sensitivity analysis to assess which assumptions matter most.

Stage 2 Develop multiple scenarios planning

Stress-test your business’ performance and strategy against each scenario by modelling the various business outcomes. Identify the areas of business which would be most at risk and where it is most resilient, while estimating the buffer or shortfall of capital in the worst-case scenario. Thereafter, assess the current slate of strategic initiatives against each scenario to determine whether each initiative should continue as planned, accelerate or stop.

Stage 3 Establish your posture and broad direction of travel

One notable feature of the Covid-19 crisis is a radical shift to distance business models. Overnight, people have massively stepped up their use of technologies that enable remote learning, working, services and consumption. While it is challenging to determine whether such massive digital adoption would continue in the new reality, it would be useful to concur on the fundamental shifts and future themes before defining any initiatives.

Stage 4 Determine actions and strategic moves which would work across scenarios

In extreme uncertainty, a rigid plan would not work. On the other hand, a very flexible plan which allows for different scenarios may be too expensive and come to naught. To seek a balance between benefit and cost, businesses should develop strategic moves that will perform relatively well as a whole across all likely scenarios.

Stage 5 Determine trigger points to act when needed

Determine a set of trigger points for when the business should begin detailed planning and execution for that move. Once the necessary move becomes highly likely, make the necessary investment to ensure that the business can act swiftly

In this aspect, accountancy and finance professionals can play a key role in supporting their employers in the development of the crisis-action plans. They can work closely with the various business units to take stock of the business’ financial assumptions, determine key financial performance drivers and estimate the buffer or shortfall of capital needed when performing multiple scenarios planning.

THE NEW REALITY

What is the new reality or next normal? No one knows for sure. However, with expected changes in the business environment, businesses would have to assess whether their existing business model is sustainable in the long run.

For example, businesses which previously relied heavily on cheap foreign labour may find that post-Covid-19 crisis, there may be more stringent health checks and certification requirements. There could also be greater regulations on a higher quality of welfare and accommodation expected to be provided by businesses for the foreign labour, which would be more costly. The cost structure and ultimately, profitability, would change for these businesses.

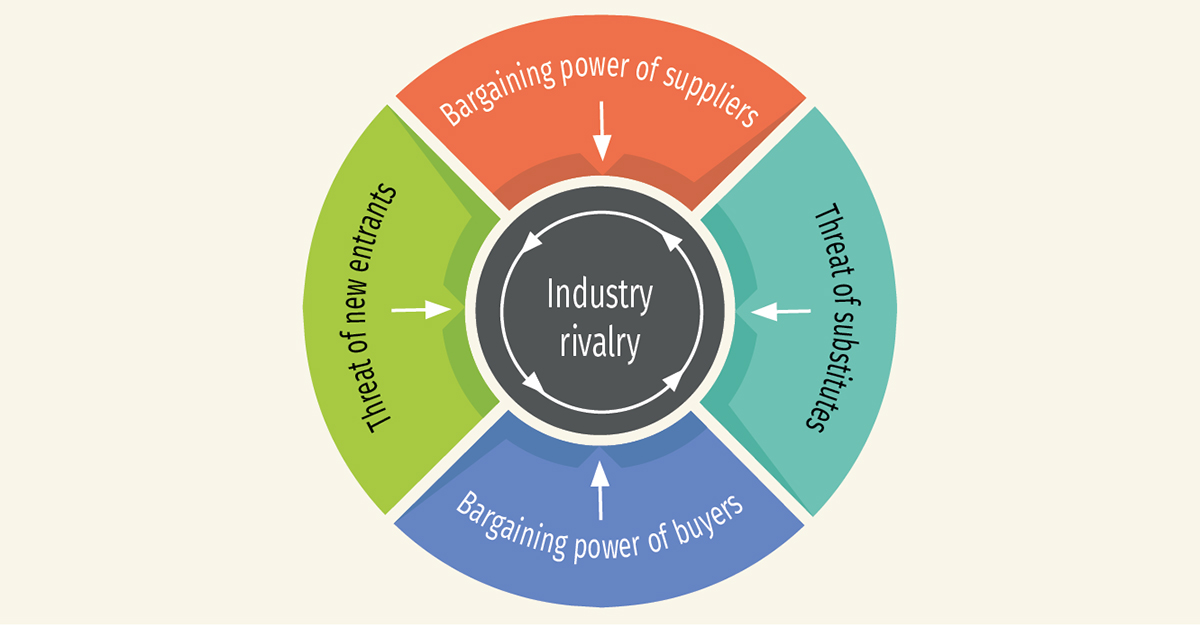

For the rest of this article, we will make reference to Porter’s Five Forces, namely the bargaining power of suppliers, bargaining power of customers, threat of new entrants, threat of substitutes and industry rivalry (Figure 1), to explore how the business environment would change after Covid-19.

Figure 1 Porter’s Five Forces Framework

1) Bargaining power of suppliers

We have seen the devastating impact of Covid-19 on the supply chain when there is a concentration risk of limited suppliers from specific countries. As highlighted in the first article of this Covid-19 Special, titled “Implications Of Covid-19 On Businesses”, published in the May issue of this IS Chartered Accountant Journal, many countries shut down their economies and ordered their residents to stay home for a period of time to minimise community spread of the virus. These stringent lockdown measures were enforced swiftly, which impacted businesses that had little time to react, and significantly disrupted supply chains. It will not be surprising to see changes to how businesses manage their supply chains going forward.

This will likely take the form of a risk assessment and risk management approach. Businesses will have to know their supply chains inside out to identify all possible risk areas. They will need to consider many factors including costs and related charges pertaining to transport and logistics, stability of supply of input materials, reliability and reputation of suppliers, geographical locations of suppliers, their proximity to where the final product will be put together and quality of their input materials, among others.

For example, according to a McKinsey report, a leading consumer company has sped up the outsourcing of manufacturing and logistics for some products to specialised vendors in different regions. This approach has not only improved the security of supply by increasing the local content, it also enabled the company to reduce costs and adjust the production volumes swiftly.

As businesses relook at their supply chains, one consideration is how much bargaining power each supplier has with them. To manage the bargaining power of suppliers, businesses should consider two key aspects in their supply chains – resilience and digitisation.

Resilience

Businesses should place greater emphasis on the risk management of their supply chains by quantifying the risks and identifying vulnerable spots. If they stick to only one major supplier, they would be at the mercy of their supplier. Suppliers will not be able to increase their costs so easily if their customers have other options to fall back on.

Where possible, business should consider diversifying their supplier base in order to limit the bargaining power of their suppliers. At the same time, businesses must recognise that there will be a cost if they want to diversify from the lowest cost supplier in return for other critical benefits. For example, if businesses work with suppliers further away from their primary manufacturing facilities, additional transport costs will need to be factored in. The cost structures of the suppliers can also be a factor. If the cost structures of the alternative suppliers are higher than the existing vendors, businesses will likely see a higher cost being charged to them if they change suppliers. Consequently, businesses may have to be prepared to forgo short-term gains to build long-term earnings and supply chain resilience.

In order for businesses to optimise their cash position post-Covid-19, having an increased visibility of their operation’s cost structure and those of their suppliers is key. For example, to proactively manage potential supply-demand imbalances, a key chemicals player has leveraged on analytical tools to anticipate changes in raw material prices. Also, as liquidity is paramount, a major automotive player has established a permanent unit within its finance function to monitor liquidity across the business. These are areas where the finance function can play an important role in helping businesses manage their cost structures.

Digitisation

Businesses can enhance resilience in supply chains using technology. Through more extensive use of technology, businesses can work towards full transparency of their entire supply chains as part of enhanced risk management. Businesses would need to encourage their suppliers to be on board this digitalisation journey with them. Otherwise, they may have to find other suppliers who are more progressive in their digitalisation efforts.

Accenture recommends that organisations build in adequate flexibility to protect against future disruptions by developing a robust framework that includes a responsive and resilient risk management operations capability. This would involve a continuous cycle of mobilising the relevant team with its initial response, sensing and prioritising new risks and implications, analysis of what-if scenarios, configuring the networks and protocols, and executing the plan to strengthen the supply chain. This enhanced capability should be primarily driven by technology, leveraging platforms that support applied analytics, artificial intelligence and machine learning. It should also ensure end-to-end transparency across the supply chain.

If businesses can build resilience in and digitalise their supply chains, the power of suppliers may be reduced. This would help the business keep its costs low and enhance its profits.

2) Bargaining power of buyers

Covid-19 has also generated a massive shift towards online shopping and deliveries as people spend more time working and staying at home. The changes in the way we work and live impact the way we consume products and services in future. In Singapore, this surge in demand has caused havoc for online supermarket platforms such as RedMart, FairPrice and Amazon Prime, which scrambled to bring on additional capacity to fulfil orders.

Having experienced the convenience and other benefits of online purchase of products and services, after the Covid-19 crisis, there could be a shift in buying behaviour as a new reality. A recent study highlighted that in China, there was a 55% increase in consumers who plan to move to online grocery shopping for good, and an estimated growth of between three to six percentage points in overall e-commerce penetration after Covid-19.

When people can once again enjoy the dine-in experience and shop in physical malls, the tide of online purchases that we witness now may somewhat subside. However, it is unlikely to be totally eradicated. Instead of brick-and-mortar stores or online shopping prevailing over each other, the new reality could see tactile consumption and online shopping blending together as a dual channel strategy. While regular retail is unlikely to totally disappear, it will evolve if takeaway and/or home delivery becomes a shift in consumer behaviour as there would be increased focus on how businesses can add value to their customers who will be spoilt for choice. The power of customers could possibly increase, which would make the business environment more competitive for certain industries.

3) Threat of new entrants

After Covid-19, there would be the rise of some profitable industries, which will attract more competitors looking to achieve profits. Such industries may face the threat of new entrants hoping to get a share of the pie.

For example, if more businesses continue work-from-home arrangements after Covid-19, learning as part of employees’ professional development will in tandem go online. Businesses in the training industry will have to keep online learning sustainable with a full suite of e-programmes to meet their clients’ needs. Businesses will have to be innovative in coming up with the progammes. This may see them working with partners such as professional bodies, industry associations or academic institutions. Ultimately, learning may be profoundly transformed.

Against the backdrop of the pandemic, the Linux Foundation saw an increase of more than 40% enrolments for its free online training courses over an average week. As people experience for themselves the benefits of e-learning, they may become more willing to pay for e-learning in the future. The e-learning market is forecasted to reach US$325 billion in 2025, and this was pre-Covid-19. Post-Covid-19, the e-learning market is expected to grow even bigger. Potential new entrants to the e-learning sector will have to consider the barriers to entry such as contents, delivery platforms, trainers, etc.

4) Threat of substitutes

A substitute product is a product from another industry that offers similar benefits to the customer as the product produced by businesses within the industry. The threat of substitutes affects the competitive environment of businesses. As customers have a choice to purchase the substitute instead of a business’ product, this could influence its ability to generate profits.

As an example, Covid-19 has substantially slowed international travel as many countries have imposed travel bans or restrictions for fear of imported infections. Although business partners cannot travel or meet in person, cross-border meetings via video-conferencing tools is proving to be a viable substitute during this time. If limitations in business travel continue, and people become more accustomed to using such tools in their work, remote meetings may well become a standard practice. After all, it costs much less than the airfare, accommodation and incidental expenses of business travel. This potential shift could lead to a decline in international business travel – particularly to hubs like London and Tokyo – and impact the aviation and hospitality industries; hospitality spans five sub-sectors, namely, lodging, events, food and beverage, tourism and transport.

Although businesses may be organising more virtual meetings as an alternative form of communication, the value of face-to-face meetings with the human touch cannot be replaced by technology. Thus, while video-conferencing is a viable substitute, it is unlikely to completely replace business travel in the medium to long term.

5) Industry rivalry

Competition among existing businesses in the same industry will get more intense during challenging times. To fight for every available consumer dollar, businesses will attempt to outdo one another with more innovative products and services.

Take the automotive industry as an example. It is likely to see an increase in bankruptcies and consolidations as the Covid-19 crisis impacts the global new vehicle production. According to Accenture, the decrease in market capitalisation will likely accelerate automotive industry consolidation and without additional funding, some players risk going bust. Small and medium-sized suppliers which face a credit crunch and cannot weather the storm will be hardest hit. This could open up opportunities for stronger and bigger suppliers to buy up some of these distressed assets, thus adding to the industry consolidation. This could also facilitate the capital expenditure investments needed to make the shift toward new technologies, such as electrification and autonomous vehicles.

Businesses must adopt a future-oriented outlook by thinking strategically and identifying financial leverage, divestitures and acquisition opportunities, as well as strategic partners. In the aftermath of a crisis, resilient players are the ones who can provide more value to customers, outperform rivals and consolidate power by gaining greater market share.

MOVING FORWARD

When the curtain eventually falls on the Covid-19 crisis, it will also mark the dawn of a new reality. The competitive environment of businesses will be impacted by some of the trends highlighted in the article. In order to capitalise and seize the opportunities in this new reality, businesses must prepare themselves and make plans now for the future.

As the saying goes, time is money. While planning must be done, what is equally important is the speed of execution. Businesses must act fast and be ready to strike when the time comes.

Perrine Oh is Senior Manager, Insights & Publications, Institute of Singapore Chartered Accountants.

This article was first published in ISCA Journal. You can read the original version here.