What can we do for small business in South Africa?

By Jameel Khan, Head of Projects at SAICA ED

As SAICA members, we should and can do more to support and develop small businesses and entrepreneurs in South Africa if we are to outlast and outperform this crisis and boost our economy.

As we all know, COVID-19 has had a devastating effect on the world economy. Although markets have recovered quite well since 2020, small businesses in South Africa and around the world have arguably been the worst hit.

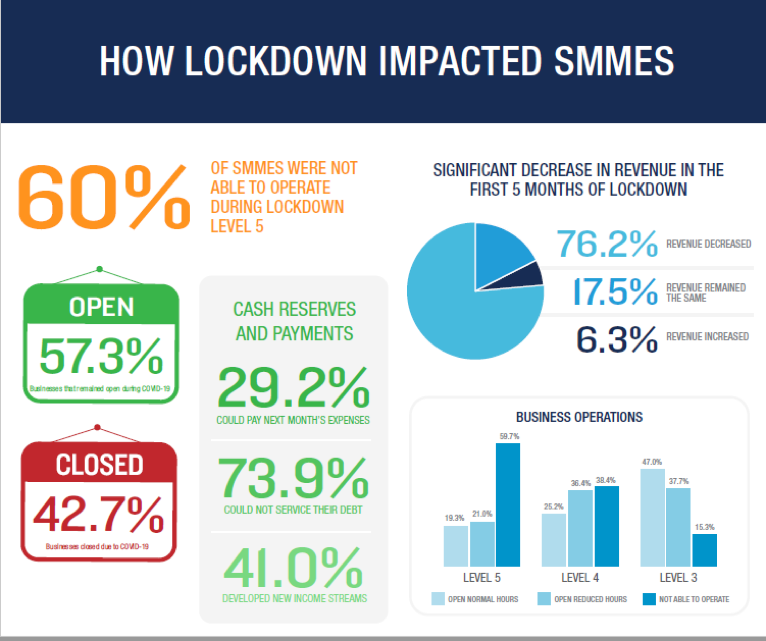

A recent survey from FinFind, in partnership with SAICA Enterprise Development (SAICA ED) and various other partners, sampled 15 000 SMMEs across all sectors in all provinces received a response rate of almost 10%.

The results of this survey and the effect on small businesses from 23 March 2020 and over the five months following were unsurprising. Some key impact stats have been highlighted below:

A full copy of the report can be found here.

However, three data points stood out in this report which we, as SAICA Enterprise Development, would like to draw attention to:

- A staggering 56,4% of the 42,7% businesses that permanently closed due to the lockdown and COVID-19 had outdated management accounts. Considering the evolution of accounting software in recent years which has migrated from the desktop to the cloud, as well as the availability of low-cost and free accounting software, even the simplest business should be able to keep some form of monthly management accounts.

- Almost 20% of SMMEs who were rejected for funding applications (this is after we eliminate the 54% who were rejected and given no reason, or who did not receive any response) were rejected for lack of financial documents and having no tax clearance certificate. This was surprising, to me since both these items are administrative in nature and should be on hand for all businesses and can be requested/downloaded at the click of a button.

- 64,7% of SMMEs highlighted that the number one item they would require assistance with in future is access to funding to grow an existing business. Thus, enabling SMMEs to become ‘funding ready’ is the primary request put forward by SMMEs for 2021 and beyond.

What do these three data points have in common?

All these points draw attention to the fact that small businesses need you!

There is a definite demand and opportunity for SAICA members to assist small businesses:

- In a cost-effective manner to produce management accounts

- In managing administrative, tax and financial documentation, and

- In supporting them to become ‘funding ready’ and connecting them to funders

What can you take away?

2020 also saw a record number of new companies being registered by the CIPC (Companies and Intellectual Property Commission). This has been deemed to be as a result of people losing their full-time jobs or people starting new side hustles.

If you are part of corporate South Africa and want to see SMMEs succeed, why not partner with us at SAICA ED to co-create an Enterprise and Supplier Development Programme to develop small businesses and entrepreneurs in your specific industry and sector.

SAICA ED aims to grow South Africa’s entrepreneurial ecosystem through advancing the sustainable growth of small black businesses, which in turn will create employment opportunities. We are powered by SAICA as part of our Nation Building Division.

- Visit: www.saica.co.za/enterprisedevelopment

- LinkedIn: SAICA Enterprise Development

- Twitter: @SaicaEnterprise