Starting a sustainability reporting revolution

By Tom Ravlic

Investors are demanding better reporting on ESG issues and a new sustainability standard setter may deliver what’s required.

In Brief

- The formation of the International Sustainability Standards Board may end a period with a fragmented reporting landscape.

- Standard setters in Australia and New Zealand will watch the ISSB’s work to ensure our standards don’t fall behind.

- Most of Australia’s top 200 companies report on ESG issues, but 66% don’t get ESG reporting externally assured.

Somewhere in the midst of the political heat on climate change measures at COP26 in Glasgow last year, a reporting revolution got its first real public airing. The International Financial Reporting Standards Foundation (IFRS) announced the creation of the International Sustainability Standards Board (ISSB), a body that will champion reporting on non financial matters. Its first key project will be, you guessed it, climate reporting.

Erkki Liikanen, the chair of the IFRS Foundation’s Board of Trustees, said the new standard setter had been created to meet a hunger for better information on non-financial issues.

“Its standards will help investors understand how companies are responding to ESG issues, like climate, to inform capital allocation decisions,” Liikanen told his COP26 audience.

“The standards will form a comprehensive global baseline of sustainability disclosures. They can be used on a standalone basis or integrated into jurisdictional requirements to serve broader stakeholder or other public policy needs.”

The ISSB will focus on meeting the sustainability information needs of investors.

Steps to a single standard

The IFRS Foundation aims to capitalise on the existing work done by other bodies on sustainability reporting. The new standard-setting board consolidates two London-headquartered bodies: the Value Reporting Foundation (VRF), a non-profit designed to help businesses and investors develop a shared understanding of enterprise value, and the Climate Disclosure Standards Board (CDSB), an international consortium of business and environmental NGOs.

The VRF’s existing suite of sustainability standards will form the basis for the new framework. Two prototype standards have been published already – one on climate-related disclosures and the other on general sustainability disclosure requirements – to get early progress on a single set of sustainability standards.

“This is the outcome of the work by the Task Force on Climate-Related Financial Disclosures [TCFD], the VRF, the CDSB, the World Economic Forum and the IASB, supported by IOSCO [the International Organization of Securities Commissions],” said Liikanen. “The aim is to consolidate key aspects of this content into an enhanced, unified set of recommendations for consideration by the ISSB.”

Much-needed harmonisation

The creation of the ISSB did not occur in a vacuum. It is, in some respects, a kind of market correction of the acceptance across the globe that a single set of accounting standards was an effective way of ensuring financial results were reported on a comparable basis to investors worldwide.

That notion led to the creation in 2001 of a single standard setter in the form of the International Accounting Standards Board (IASB) – overseen by the very same London-based IFRS Foundation – while non-financial reporting was being championed by various groups such as the VRF, the Global Reporting Initiative and similar bodies intent on filling a gap in reporting guidance.

And it is, perhaps, a natural evolution of the triple bottom line accounting framework – begun in the 1990s – which considers environmental and social effects as well as financial outcomes.

“[The ISSB] will provide much-needed harmonisation in what was a complex and fragmented reporting landscape,” says CA ANZ business reform leader Karen McWilliams FCA.

“Climate and sustainability disclosures have become key requirements for most organisations – they’re no longer a ‘nice to have’. But the lack of a robust, globally accepted reporting framework has given rise to confusion and a lack of comparability. Globally consistent reporting and common standards will also introduce greater accountability for organisations of all types.”

The ISSB will both release exposure drafts for consultation and issue final standards on disclosure requirements and climate-related disclosures.

“In New Zealand, the External Reporting Board (XRB) will continue to consult on and issue their climate-disclosure standard, which will be effective for reporting periods beginning 2023.”

“These developments present opportunities for CAs to add value to the organisations they work with and in, helping them start their journey towards a more sustainable business model,” McWilliams adds.

“Our recent playbook, How SMEs Can Create a More Sustainable World, is a must read for CAs to increase their knowledge in this space. For those working with larger entities, understanding the Task Force on Climate-related Financial Disclosures (TCFD) recommendations should be part of their professional development this year.”

Reaction in Australia and New Zealand While London will remain the hub of activity on sustainability reporting, the work of the ISSB is being actively monitored by standard setters in Australia and New Zealand.

The Australian Accounting Standards Board (AASB) and the Auditing and Assurance Standards Board (AUASB) have each outlined their approach to the development and adoption of sustainability standards, and this does not involve setting up a separate standard setter like the ISSB.

Both boards believe it is unnecessary to replicate the institutional arrangements that exist overseas to deal with guidance on sustainability, but they will keep a close eye on developments to make sure Australia does not fall behind in its reporting requirements.

“This approach is designed to take advantage of the significant experience, expertise and credibility that the AASB and the AUASB have in standard setting,” the AASB, AUASB and the Financial Reporting Council said in a joint position statement on what they have called Extended External Reporting.

The AASB issued a proposal on a voluntary framework late last year that involves adopting the TCFD’s climate reporting recommendations. Stakeholder feedback had to be in by the end of January 2022.

AASB chair Dr Keith Kendall says companies and industry groups have told the board they want “greater clarity and consistency, and this proposed framework is an important interim step.”

He says the AASB is expected to finalise its guidance on voluntary climate reporting by the end of February.

“I don’t anticipate anything new to come up based on the ad hoc consultations prior to issuing the invitation for stakeholder comments,” Kendall says.

“Some of the ad hoc feedback we’ve received has come from the corporate director community who have expressed their wish for immediate guidance.”

Kendall and his AUASB counterpart, Bill Edge, will also have some assistance from academic research on climate reporting. The two Australian boards are industry partners for an Australian Research Council-funded project by six academics looking at climate risk disclosure reporting.

Why assurance is critical

Environmental, social and governance reporting in general will not survive in a sceptical marketplace without assurance of some kind.

A review of the annual reports of Australia’s top 200 companies by PwC, released in October 2021, showed a growth in environmental, social and governance disclosure among the sample of entities.

In ESG Reporting in Australia – the full story, or just the good story?, PwC found 87% of the companies published non-financial disclosures that were meaningful; up from 58% in 2020.

The bad news was this increase in reporting was not accompanied by a similar jump in assurance. The report indicated that a worrying 66% of the companies were not getting their ESG reporting externally assured.

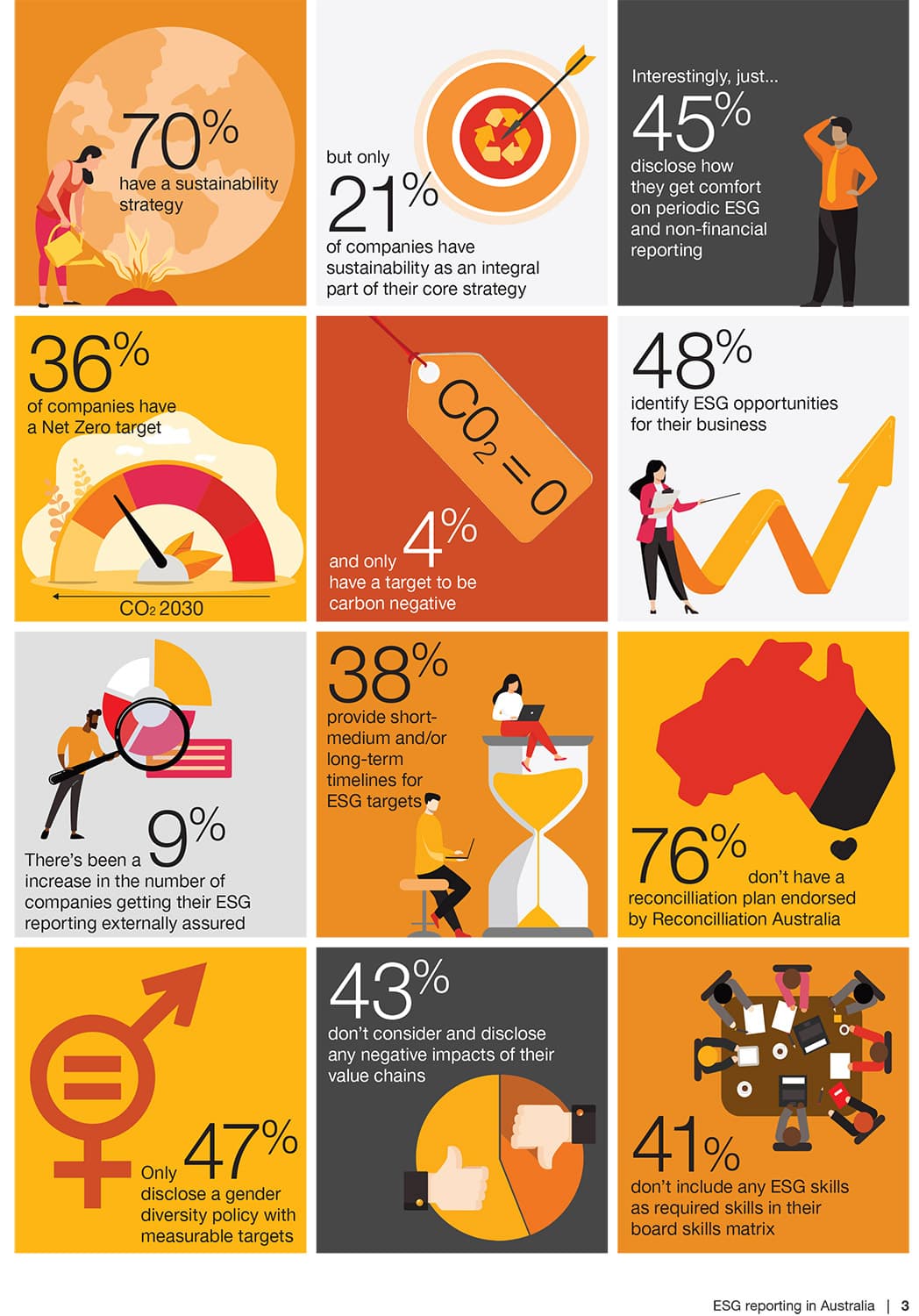

Figure 1: ESG reporting by ASX 200 companies. Source: ESG Reporting in Australia – the full story, or just the good story?, PwC Australia, Oct 2021.

PwC Australia partner and ESG assurance lead Matthew Lunn FCA says some companies still need to build skills on their boards related to sustainability. The report found that 41% of the 200 companies reviewed didn’t have ESG skills as required skills in their board skills matrix.

“With complex and rapidly changing issues under the ESG banner, boards need to be regularly assessing whether their members are suitably skilled to navigate these issues,” Lunn says.

This absence of necessary expertise also indicates a pressing need for accounting educators to incorporate extended external financial reporting standards into their curriculum.

Regulators play an important role in ensuring that reporting guidance is followed by companies, adds Lunn, but Australia has lagged other nations in requiring certain disclosures related to climate change impacts.

He believes the absence of mandatory reporting is less of a concern as companies adopt report requirements themselves to satisfy investors, but ensuring ESG reporting is adequate requires regulatory enforcement.

“I think we need to move to a point where it becomes mandatory, which gives regulators the opportunity to enforce certain things,” Lunn says. “At the moment they are a bit toothless in that regard.

The International Public Sector Accounting Standards Board (IPSASB) already has a pathway for governments to produce better quality reporting when it comes to measuring the impacts of climate change.

It has published guidance for the central role accountants can play in ensuring progress towards meeting the United Nations’ Sustainability Development Goals (SDG). (Look for RPG 1 – Reporting on the long-term sustainability of an entity’s finances and RPG 3 – Reporting service performance information.)

This article was first published by Chartered Accountants Australia and New Zealand. You can read the original article here.