Keeping Economies Moving Part 1: Plotting a course through COVID-19

How Chartered Accountants Worldwide’s member institutes helped Governments to navigate the Coronavirus crisis

As the world starts to navigate a recovery from the COVID-19 pandemic, Chartered Accountants Worldwide member institutes have spent recent months providing support, resources and advocacy to members, business and Governments.

This activity comes against a backdrop of increased trust in institutions and Government. A special report of the 2020 Edelman Trust Barometer, focused on brands and the Coronavirus, found there was a marked upswing in trust for Government and frontline industries in particular compared to previous years.

The survey of 22,000 respondents in 11 markets saw a huge jump in trust as a factor in how consumers choose brands they want to engage with, from fifth place in 2019 to second in 2020. According to Edelman’s findings, brands and institutions that gain trust are ones that work to solve personal needs while also addressing wider societal issues, and they back up words with actions.

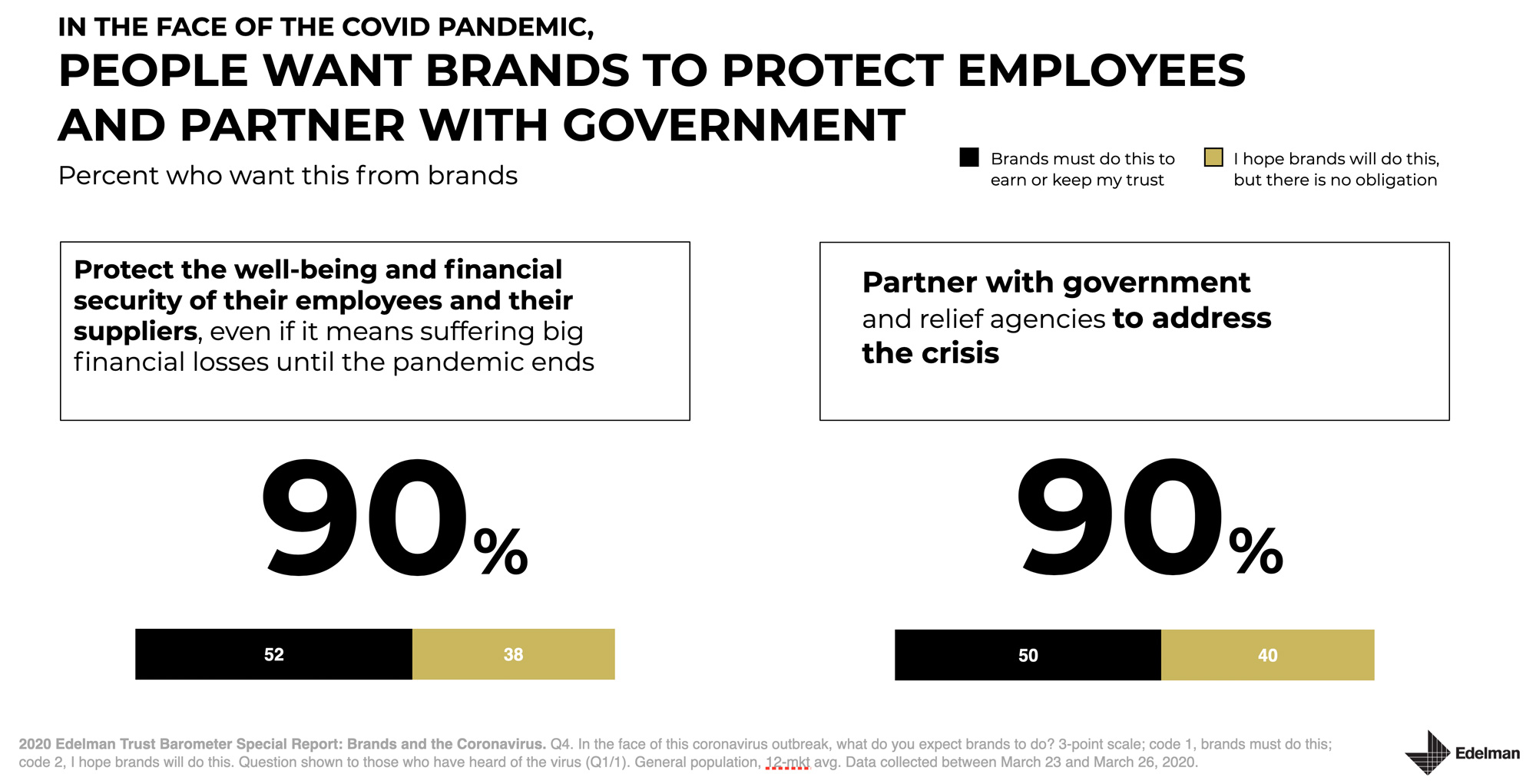

Faced with the COVID-19 pandemic, 90 per cent of people said they want brands to protect the wellbeing and financial security of their employees and suppliers at the expense of profits. The same percentage want brands to partner with Governments and relief agencies to address the crisis.

To this end, Chartered Accountancy bodies have been a major conduit to ensure millions of businesses across the world implement their Governments’ policies. Charteredaccountantsworldwide.com asked our member institutes about this work in strategically aiding the recovery.

They have responded to the crisis with a series of actions, including:

- building members’ understanding of Government support for business

- contributing to development and fine-tuning of Government policy to address the pandemic

- addressing technical accounting issues for members

- influencing Government regulators and standard setters as well as direct interventions with Government.

Here are their stories.

Australia and New Zealand: CA ANZ

Chartered Accountants Australia and New Zealand’s Advocacy, Professional Standing and International Development teams analysed the Australian and New Zealand Government’s COVID-19 stimulus packages, carried out advocacy, and published information online and in technical newsletters, podcasts, webcasts and videos, answering member queries and developing member support resources.

The Australian advocacy team took part in consultations with the Federal Treasury on the impact of COVID-19 on members and their clients. It also provided feedback to the Senate Committee on the Government’s stimulus measures. The NZ Tax team compiled suggestions from members, its Tax Advisory Group and National Tax Liaison Group, to improve New Zealand’s tax response to COVID-19.

Bangladesh: ICAB

In Bangladesh, ICAB prepared a policy paper based on members’ practical experience and worked closely with the Central Bank and other relevant stakeholders for proper disbursement and implementation of support packages for ensuring transparency and accountability.

Concerned about potential non-compliance due to the pandemic, ICAB called on regulators to extend the time period for compliance. It also supported members with guidance, seminars and discussions with Government trade and commerce bodies.

Ireland: Chartered Accountants Ireland

Chartered Accountants Ireland engaged with stakeholders, including Government agencies and regulators, around COVID-19’s impact and potential issues with filing deadlines and payments. In particular, it is working with tax authorities in the Republic of Ireland and the UK over their respective income support schemes and job retention schemes and it provides the membership with updates and insights on the latest Government initiatives. Chartered Accountants Ireland successfully lobbied for the introduction of special COVID-19 tax supports for income and corporate taxpayers, the introduction of consumer tax incentives to support businesses, and has led the debate on the need to digitise company law reporting obligations.

Indonesia: IAI

The Institute of Indonesia Chartered Accountants (IAI) supported national standards bodies in issuing reporting guidance and clarifications on implementing key standards affected by COVID-19 including COVID-19 as a non-adjusting event, expected credit losses, and fair value in a volatile market.

It provided CAs in Indonesia with access to the latest COVID-19 resources and online continued professional development activities. IAI paid special attention to supporting micro, small and medium enterprises which were among the hardest hit by the pandemic. It prepared a simplified reporting framework as a reference for these businesses in preparing financial statements.

Pakistan: ICAP

Economic recovery from COVID-19 was a special focus of this year’s proposal submitted by the Institute of Chartered Accountants of Pakistan to the Ministry of Finance. ICAP submitted sector-wide recovery and growth proposals to the Federal Government. It also hosted interactive webinars to connect the Ministry of Finance with corporate leaders and professionals. This initiative facilitated the Ministry to communicate and discuss the difficult issues openly, helping to build trust in the Government’s economic decisions.

Singapore: ISCA

The Institute of Singapore Chartered Accountants (ISCA) launched several initiatives dovetailing with the Government’s support measures. ISCA’s COVID-19 Navigator helped users understand the many support schemes from the Government and ISCA. It also worked with Singapore Accountancy Commission to issue advisories for accounting practices and help audit practitioners put in place safe management measures.

With jobs at risk from the economic fallout, ISCA worked with Workforce Singapore, a Government agency, to offer career support to chartered accountants.

South Africa: SAICA

The South African Institute of Chartered Accountants (SAICA) set up a SAICA COVID-19 website containing a wealth of technical, business and industry related guidance specifically focused on the pandemic. SAICA also released 12 educational guidance documents which are useful for large listed corporates and smaller entities using IFRS alike and are easy to follow, process and implement during the pandemic.

SAICA’s advocacy efforts included submissions to Business for South Africa (B4SA) for National Economic Development and Labour Council (NEDLAC) relief negotiations, both drafts of the two tax disaster relief bills, the various regulations on ‘essential and permitted services’ during the nationwide lockdown and on the UIF Temporary Employer/Employee Relief Scheme (TERS) benefit regulations, for which SAICA developed a calculator to assist members in calculating the relief funds to be received.

Sri Lanka: CA Sri Lanka

Among the initiatives from the Institute of Chartered Accountants of Sri Lanka were publishing technical pronouncements and guidance around accounting considerations, auditing and financial reporting. It also contacted local chambers and the Government, offering support and services to restructure and resuscitate the economy.

UK: ICAEW (England and Wales)

Since the onset of the crisis, ICAEW prioritised close collaboration with the UK Government – including HM Treasury and the Department for Business, Energy and Industrial Strategy – to support British businesses and workers. It kept members informed of UK Government policy announcements, equipping them to provide professional advice to the more than three million businesses they support.

At the centre of this was the ICAEW Coronavirus Hub, a resource regularly updated by technical experts with guidance to ICAEW members on hoe to access business support and regulatory matters such as tax and business filings. Alongside this, ICAEW sought members’ insights on the impact of COVID-19 to their clients and businesses and relayed to Government what measures were working, and what needed improvement.

ICAEW senior leadership held discussions with UK Government ministers, Opposition front bench spokespersons and other key economic stakeholders including the Governor of the Bank of England. ICAEW also provided technical expertise to UK Government Departments in delivering support schemes for businesses and taxpayers.

UK: ICAS

ICAS effectively acted as a two-way conduit between Government and the business community. ICAS ensured that the views of its members have been heard in meetings with ministers from both the UK and Scottish Governments. Both Governments have welcomed, listened and responded positively to a number of the matters ICAS raised. Ministers participated in ICAS webinars, allowing them to explain their respective policy responses to the crisis and to hear feedback from CAs on practical issues encountered by business.

ICAS also set up a Coronavirus Hub, which is continually updated as an online resource with guidance on business support, regulations, and business filings.

Across the globe, amid ongoing economic uncertainty from COVID-19, Chartered Accountants emerged as business leaders, decision makers and trusted advisors to help meet the many challenges ahead. In the process, they’re helping brands and public services to build trust. Check back regularly at charteredaccountantsworldwide.com to discover more in future articles.